Making sense of the ‘Brexit effect’ for food businesses

Last week, Barclays released a report outlining the possible effects of different types of Brexit on the UK food and drink industry. While it’s impossible to present any definitive advice on what will happen before the shape of Brexit is known, the report presents some useful insights and pointers for food businesses to consider.

About 40% of the total UK market for food and drink was imported last year. Of this 71% came from the EU free of customs duties and other trade costs. Much of the remainder comes from third countries with whom we enjoy low tariff, bi-lateral trade deals as part of our membership of the EU.

According to Barclays, in any outcome other than a full customs union, British consumers will see costs rise across the food supply chain. Indeed, average tariffs on food and drink (which could be up to 27%) would be higher than those in anyother supply chain.

Interestingly, these increased tariffs are set to hit discounters trading in meat, dairy and cereals who operate at the lower end of the market the most. This is because a large part of the tariff burden is based on weight and so doesn’t take into account quality. At the other end of the food supply chain, retailers will be worse hit due to higher rates of duty on finished products (over 30%) compared to primary and goods and raw materials (around 10%).

According to Barclays, in any outcome other than a full customs union, British consumers will see costs rise across the food supply chain.

There would also be additional non-tariff barriers to trade in food and drink. The Food and Drink Federation and AHDB have estimated that the average cost of complying with Sanitary and Phytosanitary (SPS) rules post-Brexit would be the equivalent of paying an extra 8% in duty, further exacerbating the problem.

Imports and exports

In a no-deal scenario, Britain’s food supply chain will have to be re-worked to source products from non-EU suppliers. Domestic capacity won’t be enough and, even if tariffs are lowered, some other countries won’t have SPS approval to sell their goods into the UK.

When it comes to meat imports, veterinary approval is also required before product can legally be imported into the EU. As an example, there are only a handful of countries that currently have veterinary approval to sell pig meat into the EU. In the event of a hard Brexit, the UK would be free to authorise imports from other countries that comply with those rules to improve supply.

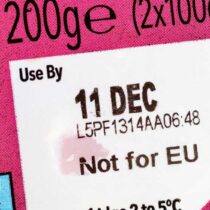

However, there is still the possibility that Government will relax SPS rules in the longer term (something it claims it won’t do) to allow currently disqualified product to be imported. It’s worth noting that this wouldn’t be allowed to happen if the Chequers plan or similar customs union scenario with the EU were to be agreed.

A hard Brexit would mean UK food and drink exports would face the same tariff rates as goods coming from the EU. Exports to other countries that already have free trade agreements with the EU could be affected if the UK Government is unable to secure an extension of those agreements.

Trade wars

An additional pressure on food supply chains comes from the impact of the trade wars currently raging around the world. The eventual effect on different parts of the industry is difficult to predict but it is highly likely that supply chain disruption, higher input costs, squeezed margins and ultimately, higher consumer prices will be the story for some time to come.

That said, the Barclays report points out that there will be instances where tariffs imposed by one country (for example the Chinese tariff on US soybeans) causes a commodity to reduce in price on international markets which could offer unexpected benefits for some manufacturers.

The message from Barclays as well as multiple other sources including Government seems to be that, although we cannot know exactly what to expect from Brexit, businesses must somehow prepare. The reality is that businesses are finding it difficult to pull the trigger on changes in strategy and capital spending in case it sends them down a path that proves to be wrong once the result of the Brexit negotiations is known.

While uncertainty prevails, BMPA will continue to alert members to the hidden, obscure and overlooked impacts and un-intended consequences of whatever our negotiators come back with. Unfortunately, how and when each individual business should act on this intelligence is a much harder question to answer.