The truth behind UK beef prices – do we have an unsustainable supply chain?

There has been much talk recently about low farmgate beef prices, with many livestock producers seeking to ‘blame’ meat processors for the current squeeze.

As is often the case, this current market situation cannot be explained simply by pointing the finger at the next link in the supply chain. It involves the whole industry from farmers through to retailers and ultimately, the consumer.

It has always been the case that everyone needs to make a profit in order to have a functioning, sustainable industry. However, some participants have more ‘wriggle room’ than others.

When we add in external market forces (for example increased meat supply or worldwide prices for skins), over which nobody has any control, the picture changes again. We’ve written about this recently.

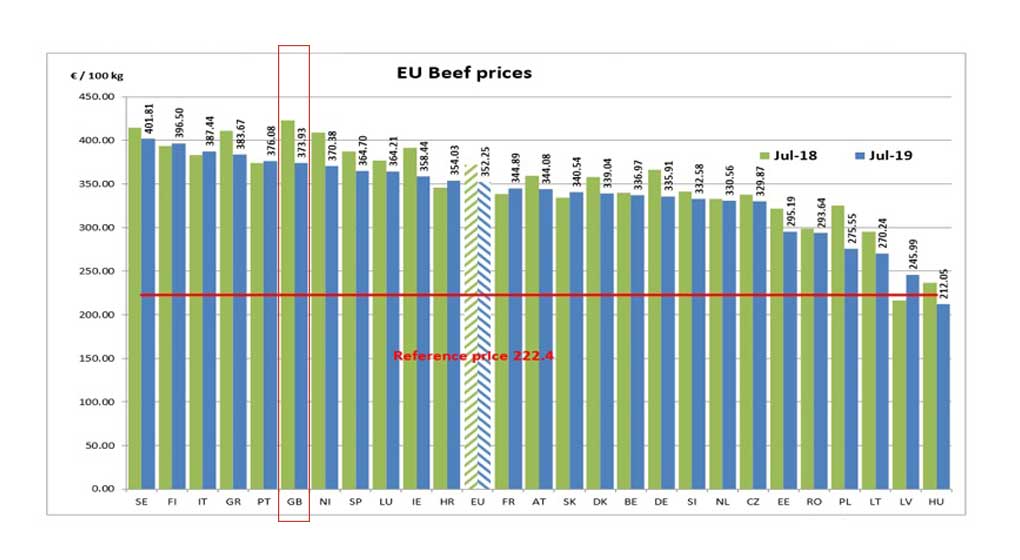

The true picture of who’s in control of prices becomes clear when we look at the UK versus the rest of the EU. The following diagrams demonstrate how meat processors have very little control over pricing and are instead, being squeezed between comparatively high livestock prices and comparatively low consumer meat prices.

While farmgate prices have dropped significantly in the last year, the British farmgate price is still one of the highest in Europe.

In a league table of retail beef prices, the UK is down in 21st place compared to the rest of Europe. The same research shows us down in the mid forties compared to the rest of the world.

It’s well known that our part of the industry operates on thin margins, often as low as one or two percent. Given that processors have very little ability to absorb price fluctuations, the current ‘perfect storm’ of an increase in supply coupled with a decrease in demand can’t be shouldered solely by meat processors.

What it does demonstrate is that the British meat processing sector is one of the most efficient in the world, but this is cold comfort given the headwinds the whole of the meat and livestock industry is facing. Indeed, all the published statistics show that farmers are making little or no profit and are dependent on government support, which economists would suggest requires a major restructuring of the agricultural sector if subsidies were to be withdrawn.

Supermarkets are exerting their size and market dominance to squeeze meat processors margins. Couple this with internationally high farmgate prices and processors have become the proverbial meat in the market sandwich.

Exports have been helped by the drop in Sterling but, as the first diagram shows, most of our closest EU trading partners enjoy lower beef prices than the UK. So, while it helps, exporting cannot be regarded as the panacea.

At the consumer end, we must ask several questions: Why is our retail price so low compared to similar countries? Is the British consumer falling out of love with meat and has the propaganda spread by the anti-meat lobby taken its toll on demand?

The answer to one of these questions’ rests with the retailers. The vast majority of meat sold in the UK is through supermarkets but, as the league tables above show, the comparatively high farmgate prices are simply not being passed on to consumers.

Part of the reason is that Britain’s supermarkets are locked into an ongoing price war with each other, and every company is determined to demonstrate to consumers that they represent the best value for money. One way of doing this is to hold meat at artificially low prices.

They achieve this by exerting their size and market dominance and squeezing meat processors margins down to where they currently are now. Couple this with livestock leaving the farm at internationally high prices and processors have become the proverbial meat in the market sandwich.

The answer is probably that all these issues contribute to the current situation and all need to be addressed as part of an overarching strategy for the future of the British meat industry.

We would go further and say that this should be a unified effort of collective prioritisation and investment across the whole of the supply chain. This requires a degree of cooperation that has until now eluded the industry but is desperately needed if we are to preserve a sustainable meat sector here in the UK.

Our message to the industry, therefore, is ‘Let’s Talk’.